Documentation for Zero Rating Export of goods

As per the UAE Federal Decree-Law No.8 of 2017, A Direct or Indirect Export of goods is categorized as one of the supplies which is subject to Zero tax rate. Although to avail such exemption, it is crucial that supporting documentation as mentioned in Article 30 “Zero rating Export of goods” Executive Regulations (‘ER”) of the Federal Decree-Law.

Retaining all the requested documents is essential as it is one of the main conditions which are required to be met by the taxable person if their supplies to be categorized as Zero-rated supplies. It is important to note that the below terminology in order to understand what all documentation is included in the below terms:

Commercial Evidence

- ●

-

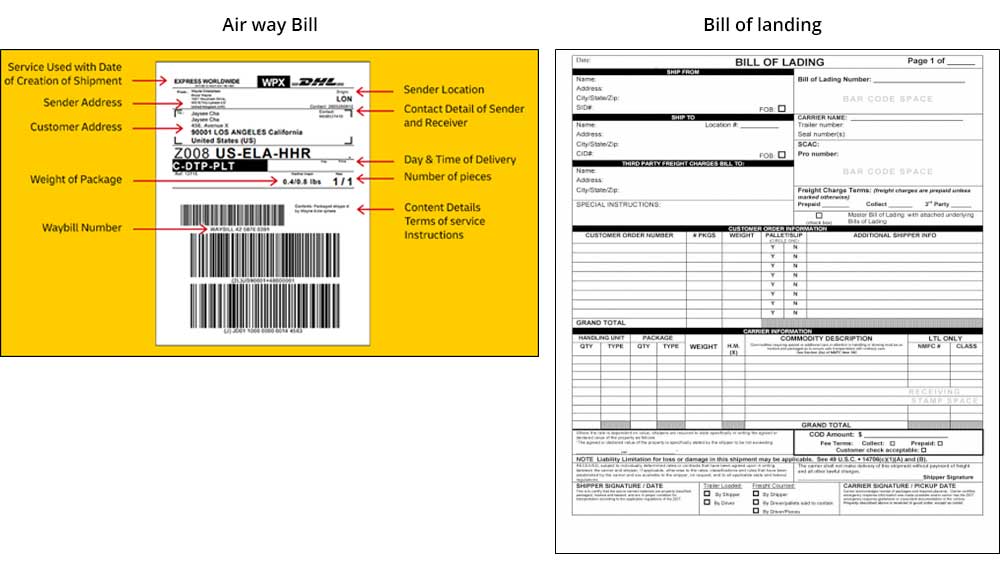

Airway bill.

- ●

-

Bill of lading.

- ●

-

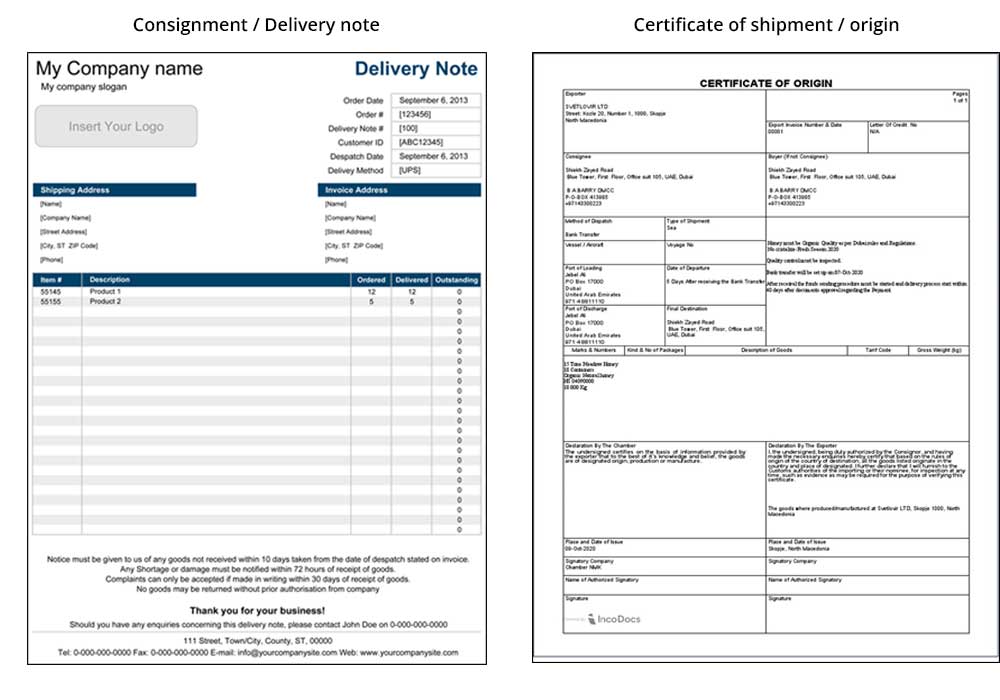

Consignment note.

- ●

-

Certificate of shipment.

Official Evidence

- ●

-

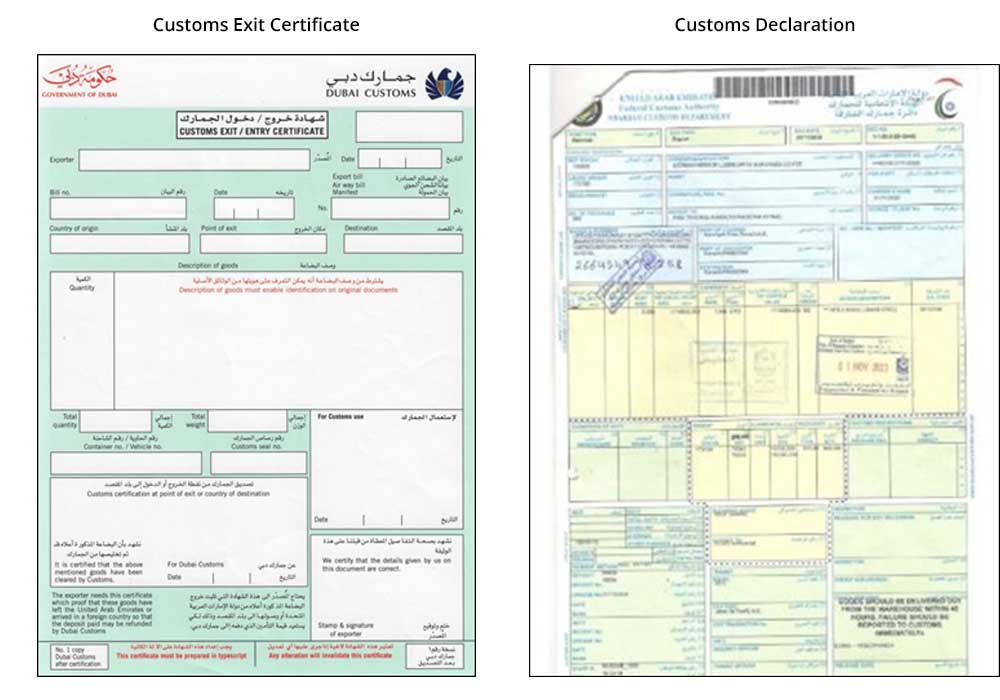

Export documents issued by the local Emirate Customs Department such as Customs declaration.

- ●

-

Customs Exit Certificate.

In all the above-mentioned documentation, the official / Commercial evidence needs to specify:

- ●

-

The supplier.

- ●

-

The consignor.

- ●

-

The Goods.

- ●

-

The value.

- ●

-

The Export destination

- ●

-

The mode of transport and route of the export movement.

Note 1: Refer appendix section for illustration of the various official / commercial documentation as mentioned above.

Types of Export

- 1.

-

Direct Export

Direct exports are the export of goods to a location outside of the Implementing States, where the supplier is responsible for arranging transport or appointing an agent to do so on his behalf.

Direct export Exports by tax payers shall be categorized as zero-rated supplies if the supporting official and commercial evidence are retained by the exporter.

- 1.

-

Indirect Export

Indirect export applies where there is an arrangement between the local seller and its overseas customer whereby the overseas customer will ensure export of goods outside UAE.

In this scenario, The Overseas Customer obtains official and commercial evidence of Export or customs suspension in accordance with GCC Common Customs Law, and provides the supplier with a copy of this.

Appendix

Commercial Evidence

Official Evidence

Points to be considered

- 1.

-

Apart from retaining supporting documentation, another condition for categorizing export of goods as zero-rated supplies is if the Goods are physically exported to a place outside the UAE or are put into a customs suspension regime in accordance with GCC Common Customs Law within 90 days of the date of the supply.

- 2.

-

The Authority may extend the 90-day period as mentioned above if the supplier has applied to the Authority in writing that:

- ●

-

Circumstances which are beyond the control of the Supplier and the Customer have prevented, or will prevent, the Export of the Goods within 90 days from the date of supply

- ●

-

Due to the nature of the supply, it is not practicable for the supplier to Export the Goods, or a class of the Goods, within 90 days of the date of supply.

United Arab Emirates

United Arab Emirates